Why life insurance to cover your mortgage?

If you have purchased a mortgage through the bank, you need to watch this video:

Our Mortgage Services

Any other debts you have

Funeral cost

The cost of child care; and

Other living expenses.

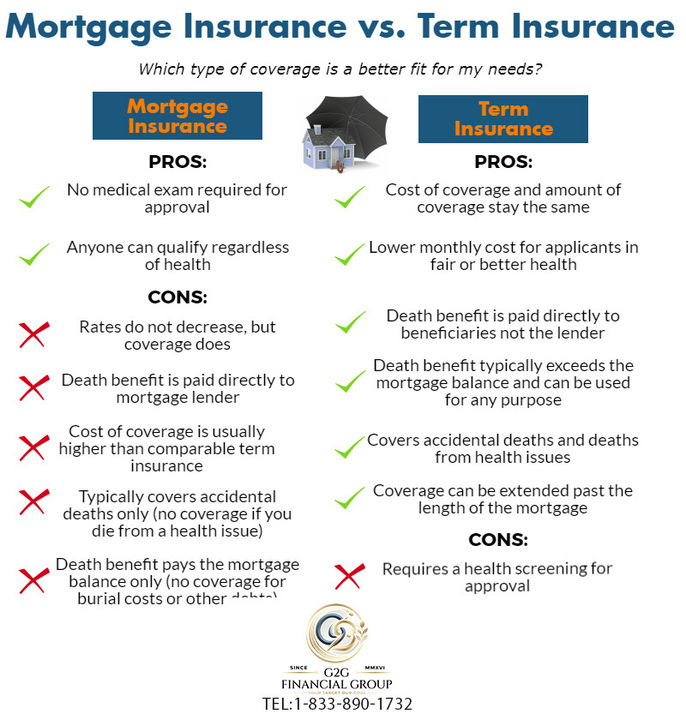

But before you decide between life insurance and mortgage insurance, here are some other important differences to keep in mind:

Does your coverage decrease over time?

With a life insurance policy, you get mortgage protection along with financial protection for your beneficiaries or loved ones. Plus, the amount of coverage you buy doesn’t decrease over time, even if you repay your mortgage.

With mortgage insurance from a lender, the cost stays the same. But the benefit decreases as you pay down your mortgage. You’re paying the same premium for a dwindling death benefit. Once you pay off your mortgage, your coverage is gone and there is no money for your beneficiaries.

Who gets the money?

With life insurance, the money goes to your beneficiary or beneficiaries.

With mortgage insurance, the money goes entirely to the lender. You buy mortgage insurance to keep a roof over your family’s head, but you’re really protecting the lender.