Key Person Insurance For Business

Business Owners

Business owners have multiple needs for a key man policy insurance, including:

• Providing income to the business to replace the skills and experience of one of the company owners.

• Creating liquidity to buy out a deceased partner or shareholder’s family to avoid unintended extended-family partnerships. This is often done in conjunction with a buy-sell agreement, which includes the instructions for what to do in the event of the death of a shareholder or business owner.

• Business succession planning and providing funds for the successful transition of the company when an owner retires. This is typically done using a key man life insurance policy with a cash value component, providing the liquidity needed to successfully transition the ownership of the company without a dramatic effect on its earnings ability and cash flow.

Key Takeaways of Key Man Life Insurance Policy Basics

• Key person insurance policy provides financial security to businesses by offering a payout if a crucial employee, owner, or executive passes away. Key person insurance cover lost revenue, recruitment, and operational costs.

• Key Man Insurance is essential for start-ups, niche businesses, companies seeking financing, and small business owners who rely heavily on specific individuals for revenue generation, technical expertise, or leadership.

• Businesses can choose between term life insurance (cost-effective, temporary coverage) and permanent/whole life insurance (long-term coverage with cash value benefits). The choice depends on the company’s financial goals and risk tolerance.

• Key person insurance coverage should reflect projected revenue loss, recruitment and training costs, debt obligations, and operational impact. Common valuation methods include the Replacement Cost Method, Contribution to Earnings Method, and Multiples of Income Method.

• Businesses often underestimate the financial impact of losing a key person, fail to reassess their needs periodically, or assume key employees will always be available. Ensuring proper coverage can prevent serious financial setbacks.

What Is a Key Man Life Insurance Policy?

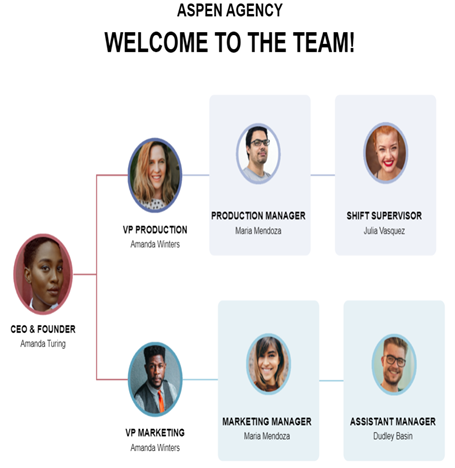

is a specialized life insurance product crafted to protect businesses from any financial setbacks if a key person in the company, like a CEO or founder, passes away or loses mental capacity.

Key man life insurance may be purchased for a variety of reasons but is most common among small- and medium-sized businesses who would find it difficult to recover from the death of a key person without transitional cash.

Every business has key individuals involved to make it a success. Some of these may be irreplaceable due to their skillset, knowledge, leadership or client relationships. In short, they’re the linchpins that keep everything together – and their absence could send the company into a tailspin.

The key person covered may be:

- a business owner

- an executive

a high-performing employee (such as a salesperson who holds a business’s primary revenue account) The Maximum Key Man Life Insurance Coverage Amounts

The general insurance company guidelines for the amount of keyman insurance available are as follows:

Employees

For an employee who owns no equity in the business, the maximum amount of coverage a company can buy is ten times the employee’s annual income.

That does not necessarily mean your business should buy ten times annual income; it’s the stated maximum. You may well find 5 to 7 times the employee’s yearly salary may be adequate, and there is no reason to have a dime more insurance than you need.

Employees with Equity Ownership

For an employee of the business who is also an equity owner, the maximum amount of life insurance a company can purchase is ten times income, plus the fair market value of their ownership interest in the business.

The Benefits of Key Man/Person Life Insurance

In any economy, continuity and stability are paramount for businesses. Key Man/Person Life Insurance is a safeguard option against any uncertainty. Let’s explore its potential benefits.

Financial Security

Should a key individual pass away or become incapacitated, the payout from the policy offers a financial lifeline. It helps offset immediate losses and keeps the company afloat during what will undoubtedly be a turbulent period. If the covered key employee passes away, the death benefit will be paid directly to the business.

Smooth Operations

Even with losing a key employee, a business’ obligations are still ongoing. The cash injection can be used to manage operational costs, ensuring minimal disruption to daily business activities and preventing potential layoffs.

Stakeholder Assurance

Stakeholders, be they investors, partners, or creditors, are reassured knowing there’s a backup plan. The policy bolsters confidence in the company’s longevity and resilience.

Talent Retention

Other employees might panic about their own jobs with the unexpected loss of a founder or CEO. This policy can help reassure workers their jobs are safe and keep talented individuals in the company.

In essence, Key Man/Person Life Insurance doesn’t just protect the business – it helps to secure its future and shield it from any potential storms.

How to Determine Who Needs Key Man/Person Coverage

Every business has that one person the company couldn’t do without. By virtue of their skills, roles or relationships, they’re a foundational pillar. Here’s how to tell who those people are:

- Crucial Revenue Drivers: Those whose contributions significantly influence profitability, such as top salespeople or lead product developers.

- Technical Specialists: Individuals with unique skills or knowledge that would be challenging and expensive to replace.

- Strategic Visionaries: Founders, CEOs, or key managers who steer the company’s direction and strategy.

- Key Relationship Holders: Those who nurture vital client relationships, partnerships, or supplier ties, holding the key to smooth collaboration and trust.

Regularly reviewing roles and contributions ensures businesses capture any evolving dynamics, guaranteeing protection remains apt and aligned with company needs.

- A highly skilled employee that would be difficult to replace due to proprietary or technical knowledge, artistic skill, or the face of the business”

Unlike traditional life insurance, which aims to provide financial support to beneficiaries like a spouse or children, this business life insurance offers a payout directly to the business. This gives the company enough money to weather financial storms, like lost revenue or time spent finding a replacement. While both traditional and key person insurance safeguard against the uncertainty of life, they have different objectives. One’s about personal legacies, the other is about shoring up a business, so it doesn’t fail.