Segregated Funds

Benefits

Segregated Funds

Segregated funds in Canada. Segregated funds, also known as “seg funds,” are a type of investment product offered by insurance companies. They are similar to mutual funds in that they pool money from multiple investors to purchase a diversified portfolio of assets. However, there are some key differences that set them apart. In this segment , we will explore the features and benefits of segregated funds, as well as how they compare to other types of investments. Whether you are a seasoned investor or just getting started, our segment on the Advantages of Segregated Funds in Canada: A Beginner’s Guide for Investors will help you understand the ins and outs of segregated funds in Canada.

What Are Segregated Funds

Segregated funds, also known as “seg funds,” are a type of investment product offered by insurance companies in Canada. They are similar to mutual funds in that they pool money from multiple investors to purchase a diversified portfolio of assets, such as stocks, bonds, and real estate. The money invested in a segregated fund is kept separate or “segregated” from the assets of the insurance company, which is where the name “segregated funds” comes from. One of the key differences between segregated funds and mutual funds is that segregated funds offer a guarantee of a return of the investor’s original capital, provided certain conditions are met, such as maturity or death. This means that even if the value of the assets in the fund goes down, the investor will not lose their entire investment. Additionally, segregated funds offer a level of protection for the investor’s assets in the event of the insurance company’s insolvency. Investors can also name beneficiaries for their segregated fund, which can provide estate planning and retirement planning benefits. These features make them an attractive option for investors who are looking for a balance of growth potential and security. Seg funds can be a good alternative for retirees or people nearing retirement who want to protect their capital and ensure a steady income stream. They also can be a good option for people who want to pass down assets to their beneficiaries in a tax-efficient way.

How do Segregated Funds Work?

Segregated funds in Canada are investment products offered by insurance companies. They work by pooling money from multiple investors to purchase a diversified portfolio of assets. When you invest in a segregated fund, you are buying units of the fund, similar to buying shares of a stock. The value of these units is determined by the performance of the underlying assets in the fund. The fund’s manager is responsible for choosing the assets to be included in the fund, and for making decisions about buying and selling assets as market conditions change. The fund’s manager also charges a management fee for their services.

One of the key features of segregated funds is the guarantee of a return of the investor’s original capital, provided certain conditions are met, such as maturity or death. This means that even if the value of the assets in the fund goes down, the investor will not lose their entire investment. Additionally, segregated funds offer a level of protection for the investor’s assets in the event of the insurance company’s insolvency. This provides a level of security that is not available with other types of investments such as mutual funds. Overall, segregated funds are a versatile investment product that provides a balance of growth potential and security.

Advantages

Advantages of Segregated Funds

Segregated funds offer a unique combination of security, diversification, professional management, flexibility, and estate planning benefits which makes it an attractive option for many investors. The capital guarantee and the protection of assets in case of the insurance company’s insolvency makes it an ideal investment for those seeking secure investments.

Take a look at the various advantages of segregated funds:

Capital Guarantee: One of the key features of segregated funds is the guarantee of a return of the investor’s original capital, provided certain conditions are met, such as maturity or death. This means that even if the value of the assets in the fund goes down, the investor will not lose their entire investment.

Protection of assets: Segregated funds offer a level of protection for the investor’s assets in the event of the insurance company’s insolvency. This provides a level of security that is not available with other types of investments such as mutual funds.

Estate planning benefits: Investors can name beneficiaries for their investments, which can provide estate planning benefits. This can be particularly useful for people who want to pass down assets to their beneficiaries in a tax-efficient way.

Diversification: Segregated funds provide investors with access to a diversified portfolio of assets, which can help to spread risk and provide better returns over the long-term

Professional management: Segregated funds are professionally managed, which means that the fund’s manager is responsible for choosing the assets to be included in the fund, and for making decisions about buying and selling assets as market conditions change. This can provide peace of mind for investors who don’t have the time or expertise to manage their own investments.

Flexibility: Segregated funds offer a range of investment options and features, such as the ability to switch between funds, make additional contributions, or withdraw money at any time. This makes them a flexible investment option that can adapt to the changing needs of investors.

Disadvantages of Segregated Funds

Segregated funds also have some disadvantages such as slightly higher fees, limited liquidity, limited choice, complexity, market risk, and limited transparency. These disadvantages can make it more difficult for investors to make informed decisions about whether to invest in a segregated fund or not. It’s important for investors to weigh the pros and cons of segregated funds carefully and consult our financial advisors before making an investment decision.

Take a look at the disadvantages of Segregated Funds

Higher fees: Segregated funds typically have slightly higher fees than other types of investments such as mutual funds. This is because they offer a guarantee of a return of the investor’s original capital, which increases the cost of providing the fund.

Limited liquidity: Segregated funds can have limited liquidity, meaning that it can be difficult to sell units of the fund quickly or at a fair price. This can be a problem for investors who need to access their money quickly.

Limited choice: The number of segregated funds available to investors is typically more limited than other types of investments such as mutual funds. This can make it more difficult for investors to find a fund that meets their specific investment objectives.

Complexity: Segregated funds can be more complex than other types of investments, which can make it more difficult for investors to understand the features and risks of the fund. This can be a problem for investors who are not familiar with the investment industry.

Market risk: As with any investment, segregated funds are exposed to market risk. This means that the value of the fund can go down as well as up, and investors could lose money.

Limited transparency: Some insurance companies may not provide as much information about the underlying assets and the fund’s management as other types of investments such as mutual funds. This can make it difficult for investors to assess the performance of the fund and the skill of the fund manager.

Now let’s continue on with our segment about the Advantages of Segregated Funds in Canada!

Benefits

Segregated Funds

Segregated Funds vs Mutual Funds

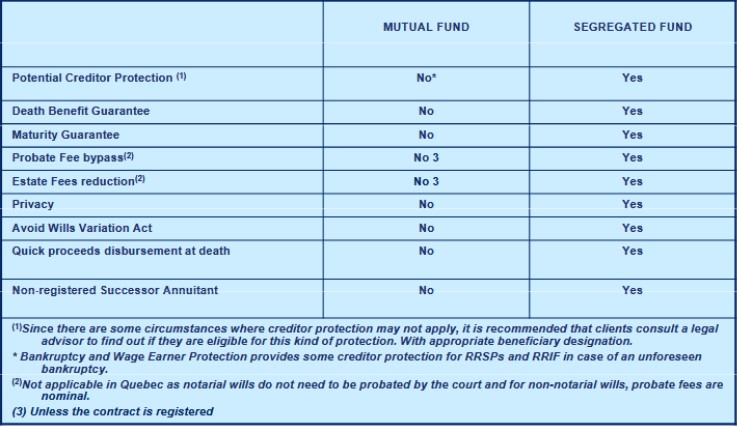

Segregated funds and mutual funds are both types of investment products that pool money from multiple investors to purchase a diversified portfolio of assets. However, there are some key differences between the two that investors should be aware of.

One of the main differences between segregated funds and mutual funds is the guarantee of a return of the investor’s original capital. Segregated funds offer this guarantee, provided certain conditions are met, such as maturity or death. This means that even if the value of the assets in the fund goes down, the investor will not lose their entire investment. Mutual funds, on the other hand, do not offer this guarantee and investors can lose their entire investment if the value of the assets in the fund goes down.

Another difference between the two is the level of protection for the investor’s assets in the event of the insurance company’s insolvency. Segregated funds offer a level of protection for the investor’s assets, while mutual funds do not. Additionally, Segregated funds offer the ability for investors to name beneficiaries, which can provide estate planning benefits.

Segregated funds also tend to have higher fees than mutual funds, as the guarantee of a return of the investor’s original capital increases the cost of providing the fund. They can also have limited liquidity, meaning that it can be difficult to sell units of the fund quickly or at a fair price.

On the other hand, mutual funds typically have lower fees and more liquidity. They also offer a wider range of investment options, making it easier for investors to find a fund that meets their specific investment objectives. Additionally, mutual funds are more transparent and provide more information about the underlying assets and the fund’s management which can help investors to assess the performance of the fund and the skill of the fund manager.

Seg vs Mutual Funds

Overall, the choice between segregated funds and mutual funds will depend on an investor’s individual financial goals and risk tolerance. Segregated funds may be a good option for investors who are looking for a balance of growth potential and security, especially retirees or people nearing retirement who want to protect their capital and ensure a steady income stream. Mutual funds may be a better option for investors who are comfortable with a higher level of risk and are looking for lower fees and more investment options. It’s important for investors to consult with a financial advisor to determine which type of investment is best for them.